In the world of digital banking, it can be hard to find a provider that is reliable, secure and customer-focused. That’s why one must consider Strands; an innovative digital banking platform that caters to the needs of its users. Strands offers an array of services such as Analytics & Data Management and Implementation Support. The company prides itself on delivering an exceptional customer experience, which includes features like providing helpful information within their app and offering personalized advice to customers. In this blog post, we will look at what Strands has to offer and how they compare to other digital banking platforms. We will also explore the various ways Strands stands out from traditional banks and provide insight into what makes them a great choice for those looking for a simple, efficient and secure way to manage their finances.

What is Strands?

Strands is a digital banking software company that creates experiences for banks and financial institutions. Strands' mission is to help financial institutions succeed in the digital age.

Strands provides a suite of products that helps banks and credit unions engage with their customers and members. The company's flagship product is Strands Finance Suite, which includes products for personal finance, loans, and investments. Strands also offers products for small business banking, commercial banking, and wealth management. In addition to its product offerings, Strands provides services to help financial institutions with digital transformation. The company's services include strategy consulting, user experience design, and technology implementation.

Products offered by the brand

Strands offers a suite of digital banking products that provide users with a seamless, convenient and secure experience. The company's products include:

Strands Personal Financial Management Platform (PFM)

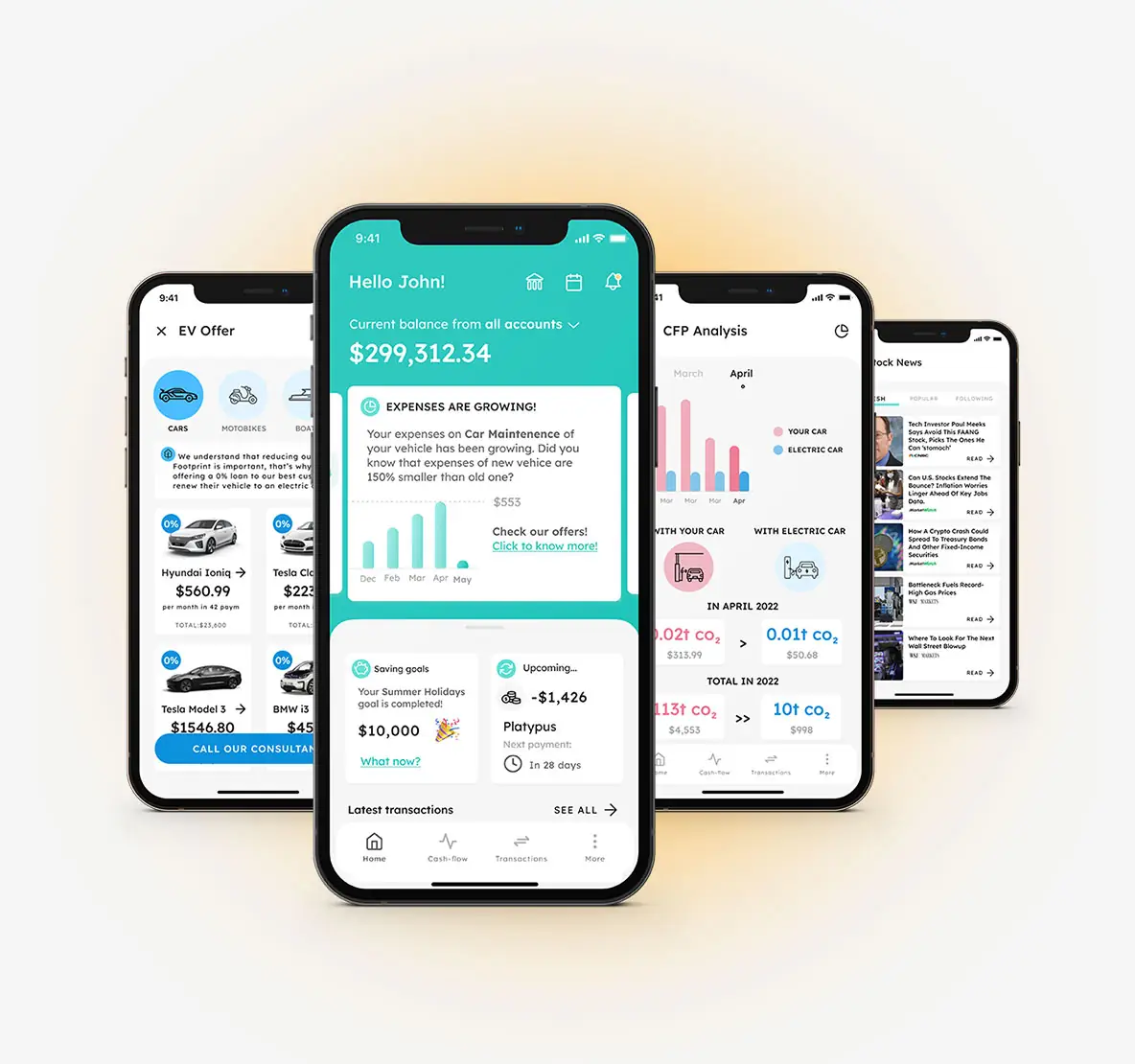

Strands PFM is a personal financial management platform that helps users manage their finances and make informed decisions about their money. The platform provides users with insights into their spending habits, income, and debts, as well as tools to help them plan for their future. Strands PFM is a free service that is available to all Strands users.

Key Features:

- Thanks to spending categorization and banking personalized insights tailored to your real needs going beyond your traditional socio-demographic data.

- Detect spending patterns and visualize them easily to take the next best action according to your financial situation.

- Boost real financial wellness with tailored solutions that remove the surprise factor.

Strands Business Financial Management (BFM)

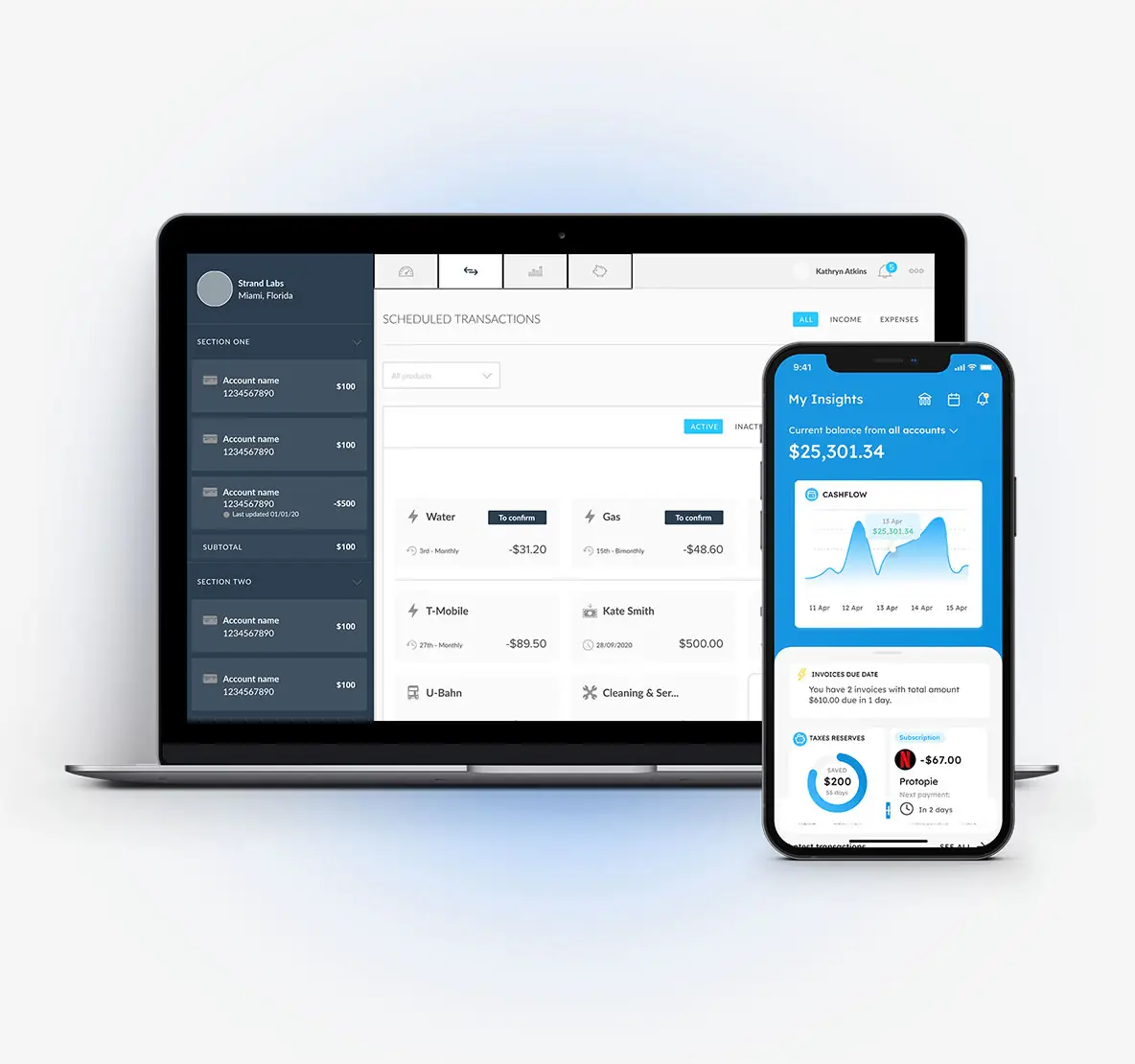

Strands Business Financial Management (BFM) is a tool that small businesses can use to manage their finances. The tool provides users with real-time insights into their spending, income, and profitability. It also offers features such as budgeting, expense tracking, and financial forecasting. Strands BFM is available on both web and mobile platforms, making it accessible to business owners on the go.

Key Features:

- Matching banking accounts views with AR/AP reconciliation for an effortless control.

- Focus on your business growth thanks to personalized advice about the next best action to take.

- Gain peace of mind with automatic and accurate forecasting detecting patterns and AR/AP predictions.

Strands Engager

What really sets Strands apart is their focus on customer engagement. They believe that banks should be using technology to create deeper relationships with their customers. With Strands, banks can do just that. Their solutions make it easy for banks to connect with their customers and provide them with the personalized service they crave. Whether it's through targeted marketing campaigns or real-time fraud alerts, Strands is helping banks build stronger relationships with their customers – one digital interaction at a time.

Key Features:

- Analyze and have a full and complete understanding of customer financial situation (i.e. cash flows trend, invoice payments).

- Personalized communication based on behavior to suggest finances and balance optimization products (i.e. credit cards, loans).

- Customized insight based on spending profile and investment capacity for one-to-one conversations.

Request a Demo

If you're interested in seeing how Strands' products can help your banking institution provide a better digital experience for your customers, request a demo today. One of their experts will walk you through their various features and show you how their platform can be customized to meet your needs. They'll also answer any questions you have about their products or services. To get started, fill out the form on their website and provide t hem with some basic information about your institution. They'll then be in touch to schedule a time that works for you.

How to sign up?

In order to sign up for Strands' services, customers must first create an account on the Strands website. Once they have done so, they can then choose the type of service they would like to sign up for. For example, they may choose to sign up for the company's online banking service or its mobile app.

Once they have made their selection, customers will need to provide some personal and financial information in order to complete the sign-up process. This includes their name, address, date of birth, and Social Security number. They will also need to create a username and password for their account. After providing all of the necessary information, customers will be able to start using Strands' services right away. They will be able to access their account online or through the mobile app and begin managing their finances accordingly.

Connect with experts for help

If you're looking for help with your Strands account, there are a few experts you can connect with for assistance. The first is the customer support team, who are available 24/7 to answer any questions you may have about your account or digital banking experiences. You can also connect with the Strands community on social media platforms like Twitter and Facebook, where other users may be able to offer advice and support. Finally, if you're having technical difficulties with your account, you can reach out to the Strands development team directly via their website. Whatever issue you're facing, there's an expert out there who can help you resolve it.

Concluding it…

Strands is an innovative new digital banking platform that provides users with a more personalized, convenient, and secure money management experience. With its dedication to customer service excellence, advanced technologies like AI and machine learning, quick transactions times and integrated offerings across the financial landscape, Strands is revolutionizing the way customers interact with their finances. The combination of all these features makes it easy to see why so many people are drawn to Strands as one of their preferred digital banking solutions.